Loan Performer allows you to disburse a loan in kind, rather than cash. This is possible for institutions that give out loans to clients in form of equipment or supplies instead of cash. And can team up with a company that can be used to supply the items needed by their clients and all it does is to pay the service provider for items offered as loans to its clients/ members.

Take an example of a Micro Finance Institution (MFI) that buys solar panels from a supplier for disbursement in kind to its clients.

To accomplish this you have to register the supplier (creditor); enter the supplier invoice into Loan Performer and then record the disbursement in kind.

How to register a Supplier (Creditor)

To do this you go to menu Accounts->Purchases and Sales->Creditors and a screen like the one below shows up:

Fill in the suppliers details and click the Save command button to complete the registration.

NB: For further information regarding the registration of creditors refer to Creditors.

How to enter supplier invoice

To enter the details of an invoice received from the creditor, you go to Accounts->Purchases and Sales->Invoices Received and a screen like the one below shows up:

How to make a Disbursement in kind

The loan application, loan registration fees (if charged) and loan approval processes are done normally. To make a loan disbursement in kind you go to Loans\Loan disbursement and a screen like the one below shows up:

Tick the check box for the option Disbursement to supplier as shown above: A list of all registered creditors will be displayed in the creditor selection screen that pops up. Select the creditor from the displayed list. The Paid to; Bank Name; Branch Name; and Account No. fields will be refreshed with the relevant creditor information as shown above:

NB: For any other settings refer to Loan Disbursement.

NB: For further information regarding the payment of creditors refer to Payments of Invoices Received

Disbursement to a borrower who has supplied goods or services (Mark up)

Loan Performer allows the institution to pay its client who also happen to be its suppliers.

Mark up: This is the amount that is the excess of the loan amount over the invoice amount when a creditor who also supplied the institution is paid by balancing off.

For instance a client (George William) who supplied goods worth 4,400,000 (Invoice amount) also applied for a loan worth 5,000,000. At disbursement and when the option disbursement to supplier is chosen, select the invoice number from the drop down, the excess of 560,000 less any fees or commission will posted to the mark up account. This will be the amount the client will receive

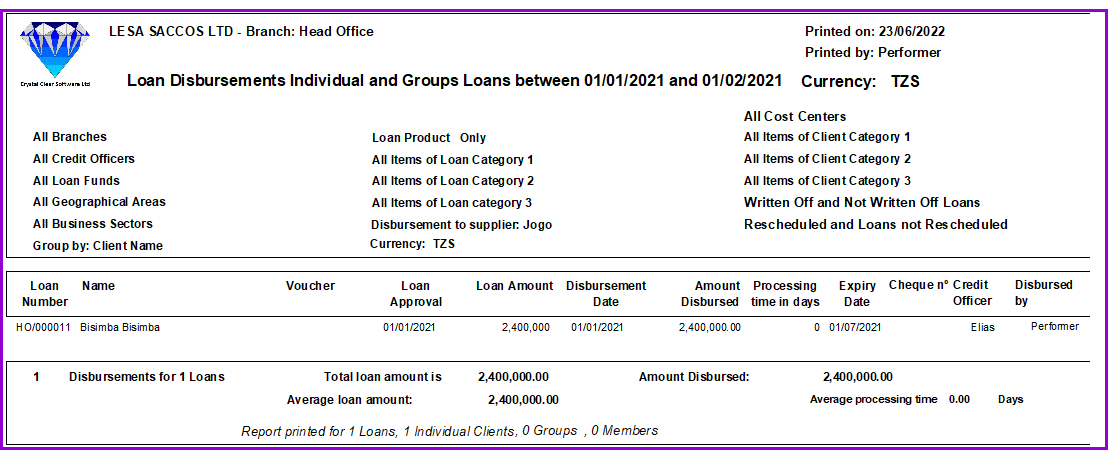

We are looking at the disbursement to Basimba Basimba who takes the Computer but the monetary value is paid into Jogo (Creditor's) bank account in NMB ltd. i.e. the client only takes the product (Computer) but the money is paid into the Suppliers bank account.

Additional notes

To view how this is booked by Loan Performer you go to Accounts\GL Transaction\Transaction. The entry of the received invoice from the supplier is booked as a debit to the stock account and a credit to the creditors account for the amount of the invoice as shown below

Now look at the disbursement: The stock account has been credited with the disbursed amount, the loan account (124010) has been debited, the bank account (126000) has been credited and the creditor’s account (221021) has been debited.

The total balance on the creditors account (i.e. Jogo) is now 100,000 credit while the same balance is found on the Solar Panel account as a debit.

This is the situation after three members have received their solar panels. By the time all members have received all the solar panels, the creditor's account will be zero as well as the stock account.

The Nº 1 Software for Microfinance